In summer 2025, Opportunity Zones, were established as a permanent federal program. Opportunity Zones (OZs) are low-income census tracts, which investors can make qualifying investments into new projects and enterprises in exchange for federal capital gains tax reductions.

Since they were first established as a pilot program in 2017, OZs have encouraged investors to invest in new housing and other real estate projects across the country, including in Ohio.

The One Big Beautiful Bill Act (OBBBA) made programmatic adjustments to and made permanent the federal Opportunity Zones tax credit program. The revamp is being called “Opportunity Zones 2.0". These changes include:

A narrowed definition of low-income

Thresholds for eligibility reduced from 80% of areawide median family income to 70%,

The ability to nominate contiguous tracts has been repealed

There are larger tax incentives for investments made in Qualified Rural Census Tracts and a 50% reduction in substantial improvement threshold for properties acquired and improved in rural areas.

Ohio is expected to see about 20% fewer eligible tracts due to the tightened eligibility.

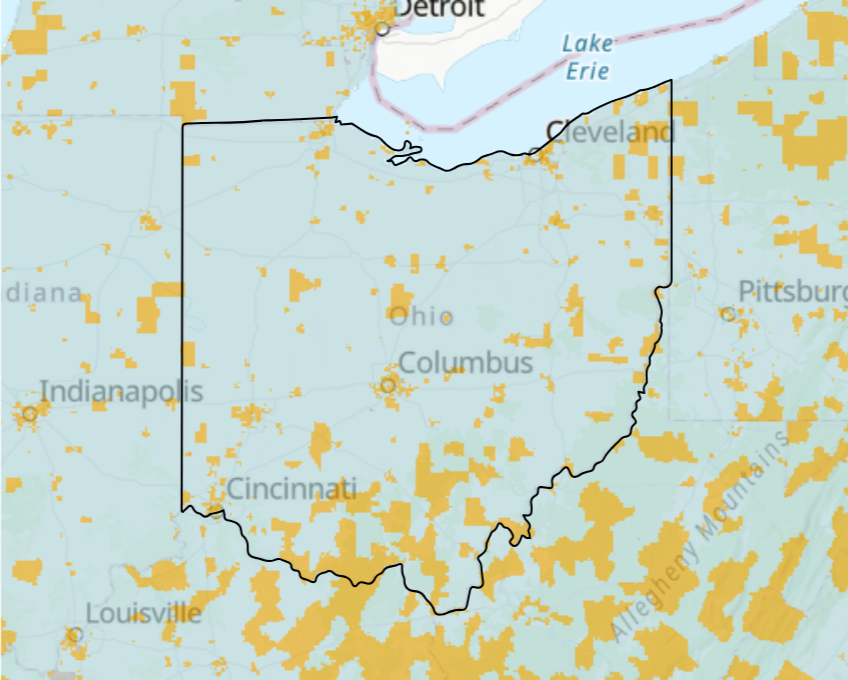

Here is a map of tracts that are expected to be eligible in Ohio. The map may change slightly in Spring 2026, after new census data are released. Check back in Spring 2026.

GOPC has prepared a website with tips for what communities can be doing now to prepare for the new round of designations that will be required. Census tract nominations must be submitted in the summer of 2026, so now is the time to communities to prepare. This page includes information on that the new benefits included in OZs 2.0 will include, what we know about the designation process, and what communities can do now to get ready.

This also includes recently published guide from the Economic Innovation Group (EIG) Guidance for Governor’s and Mayors: A Playbook for High-Impact Designations.