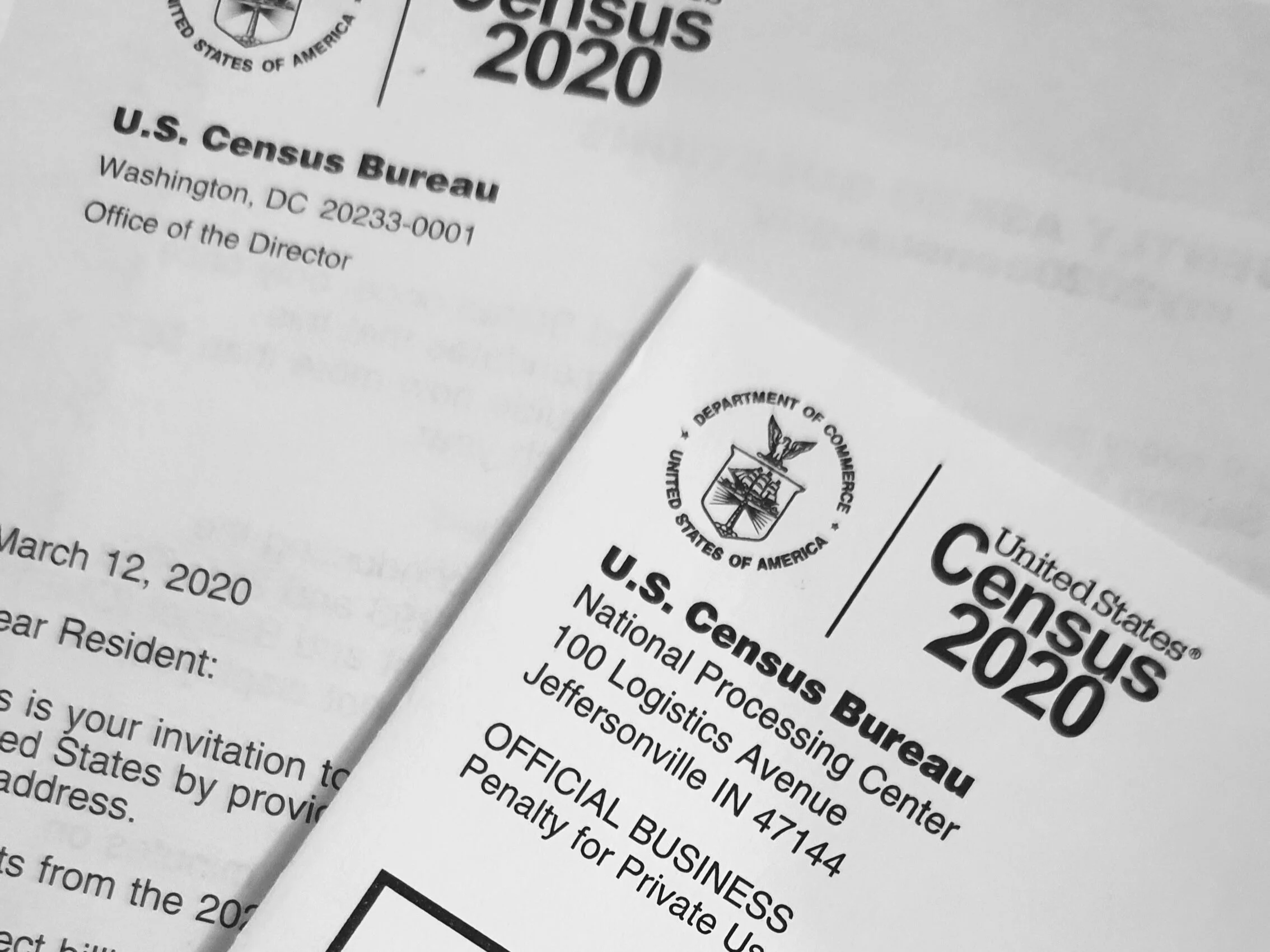

Back in March, we wrote about how the 2020 Census would be one of the most critical decennial counts in a generation, not just because of the apportionment of congressional representation, but also in determining how to allocate billions of dollars in federal funding that flows into states and communities each year.

TDI demonstrates a state-level initiative to spur development to Massachusetts’ most distressed communities.

Vermont’s Housing and Conservation Trust Fund: Dually Promoting Land Preservation and Protecting Affordable Housing

GOPC Contributes to Newly Released Cleveland Tax Abatement Study

The study was led by nationally-recognized Reinvestment Fund, with assistance from Greater Ohio Policy Center, PFM Group Consulting, Neighborhood Connections and Leverage Point Development.

A Closer Look at Workforce in Ohio's Legacy Cities

Ohio’s municipalities primarily rely on income tax to fund their operations and services. The tax is collected by the jurisdiction in which the worker works, not where they reside. In the work-from-home (WFH) environment, the questions have become, “where do these workers work?” and “which jurisdiction gets their income tax?”

How Massachusetts Helps Local Jurisdictions Attract Market-Rate Housing

In many weak-market neighborhoods, public investment is often required to catalyze private development. However, in legacy cities, local governments often do not have the resources to take this first step towards revitalization, which presents an opportunity for states to support local municipalities.

New Jersey's Transit Village Initiative: Revitalizing Legacy Cities with Transit-Oriented Development

The New Jersey Transit Village Initiative is an excellent example of how states can utilize policy to support local communities in providing residents with an enhanced quality of life and transportation options. It supports legacy city revitalization by incentivizing growth and economic activity in existing urban centers, supporting public transportation, and promoting sustainable land-use practices.